A presidential election cycle unlike any other is nearing its completion, with the only certainty being that President Joe Biden will not serve a second term. Voters are now set to cast final ballots on Tuesday, Nov. 5, to decide whether Vice President Kamala Harris will drop the “vice” and step into her boss’ current role or Donald Trump will return to office for a second term.

The ballot box will also decide how the country handles topics like climate, sustainability and ESG, as Harris and Trump broadly represent different ends of the spectrum on the issues.

Both presidential candidates somewhat agree on expanding U.S. oil and gas production, imposing some form of tariffs on Chinese-manufactured cleantech and electric vehicles and supporting nuclear energy infrastructure. Otherwise, they take contrasting approaches on the topic of climate.

“We expect diametrically opposed impacts on issues advocated by ESG investors, depending on which candidate is elected,” Tom Kuh, Morningstar Indexes’ head of ESG strategy, said in emailed comments. “In the starkest terms, a Harris administration would be more favorable for the interests of ESG investors whereas a Trump administration would be antagonistic.”

However, either administration would only be as empowered to make moves on ESG-related issues, particularly legislation, as the power split between Congress and the White House allows, according to Ernst & Young Global Tax Policy Leader Aruna Kalyanam.

“That makeup of Congress is going to matter so much,” Kalyanam said in an interview.

Here’s a look at how a Harris or Trump administration would impact the ESG and sustainability landscape.

Kamala Harris

Harris has had a good track record when it comes to vouching for climate and social justice policies. However, she has not made climate a key tenet of her campaign as she looks to ensure a broad appeal.

As a California senator, Harris was an early sponsor of the original Green New Deal, a slate of proposals aimed at addressing climate change and investing in renewable energy. Shortly after, she introduced the Climate Equity Act of 2020, which sought to highlight the impact of new environmental legislation or federal investments on low-income and vulnerable communities. This law would have also required federal agencies to prepare a climate and environmental justice analysis for a proposed or final rule that could impact such communities.

As vice president, Harris cast the tie-breaking vote to pass the Inflation Reduction Act to help incentivize and increase domestic production of clean energy technologies. The law, one of Joe Biden’s signature legislations, was signed into law in August 2022 and includes more than $369 billion in climate and clean energy tax incentives.

What a Harris win means for climate and ESG

Despite her background on the issue, Harris has refrained from making climate change-related policy a cornerstone of her campaign since securing the 2024 Democratic ticket nomination in August. She has mentioned the issue only a handful of times since, without providing specifics.

In her otherwise wide-ranging speech at the Democratic National Convention in August, Harris brought up climate briefly when speaking on what “fundamental freedoms” were at stake, highlighting the “freedom to breathe clean air and drink clean water and live free from the pollution that fuels the climate crisis.”

This stance is seen as a strategy to appeal to more voters across the U.S., especially the centrists who don’t have a clear standing on climate change, according to experts.

“[Her strategy] definitely shows a sign of intelligence and navigation, because she doesn’t know yet where the centrist voter lies when it comes to climate change,” Julie Anderson, a professor and program director for the sustainability management program at American University’s Kogod School of Business, told Fashion Dive sister publication ESG Dive Thursday.

“She’s definitely trying to secure a victory … and, in order to secure a win, she needs to attract the widest part of the centrist voter,” Anderson said.

However, despite Harris’ recent display of caution, environmental advocates, climate experts and politicians expect her to be a vocal advocate of climate change, if elected, and enact policies that propel the country toward a clean energy transition.

“A Harris administration would look to create further regulation to protect at-risk communities from the adverse effects of an accelerated transition, centered around creating job security and opportunity in areas traditionally reliant on fossil fuel employment,” said David Shepheard, an energy and utilities expert at management consulting firm Baringa.

“Democratic policy [under Harris] would also likely continue to focus on increasing manufacturing capacity to provide domestic sourcing of key clean technology components in order to reduce exposure to foreign manufacturers and create green jobs domestically,” he added.

Experts predict Harris will build on the climate progress made under President Joe Biden’s tenure, which include efforts to bolster the voluntary carbon market, strategies to slash greenhouse gas emissions generated by super pollutants, and a pledge to cut greenhouse gas pollution in the U.S. by half by 2030, compared to 2005 levels.

Anderson — who spent over three decades in asset management and oversaw BlackRock’s suite of sustainable exchange traded-funds prior to her pivot to academia — said Harris, “for the most part,” will continue many of the policies introduced under the Biden-Harris administration, particularly IRA implementation and the expansion of EV infrastructure and subsidies.

Harris is “playing the long game” when it comes to climate policy, according to Anderson. She said an administration under the Democratic candidate will remain dedicated to maintaining the nation’s role as an international climate leader and will prioritize global cooperation.

Shepheard echoed this: “Harris has long been a proponent of international cooperation, so she will likely remain part of the Paris Agreement and continue to fund international decarbonization efforts,” he told ESG Dive Thursday.

Biden rejoined the global climate treaty on his first day in office as the president in 2021 after former president Donald Trump formally withdrew from it in 2020.

The fate of SEC rules

A Harris victory would also safeguard several climate-focused regulations whose fates hang in the balance, especially the Securities and Exchange Commission’s climate-risk disclosure rule.

Though the climate rule was finalized in March, it was immediately met with several legal challenges. The agency stayed the rule in April as it continues to work through the lawsuits.

The final rule requires large companies to disclose climate-related risks that have had or are “reasonably likely to have” material impacts for companies; any mitigation or climate adaptations they have undertaken “as part of its strategy;” the use, if any, of internal carbon prices, transition plans or scenario analysis; and processes related to oversight and management of climate risks. Investors have increasingly asked for such information to be disclosed in a standardized, comparable manner.

The SEC also has several other ESG-related regulations on its agenda, including rules concerning greenwashing, human capital management and corporate diversity — all of which are either in the rulemaking process or pending finalization. With just a few days left until the Nov. 5 presidential election, it is looking increasingly likely that these rules may bleed into the next administration’s tenure.

“A Harris administration would support proposed SEC climate disclosure rules for corporations, currently being challenged in the courts,” Kuh said. “Trump would roll back the rules.”

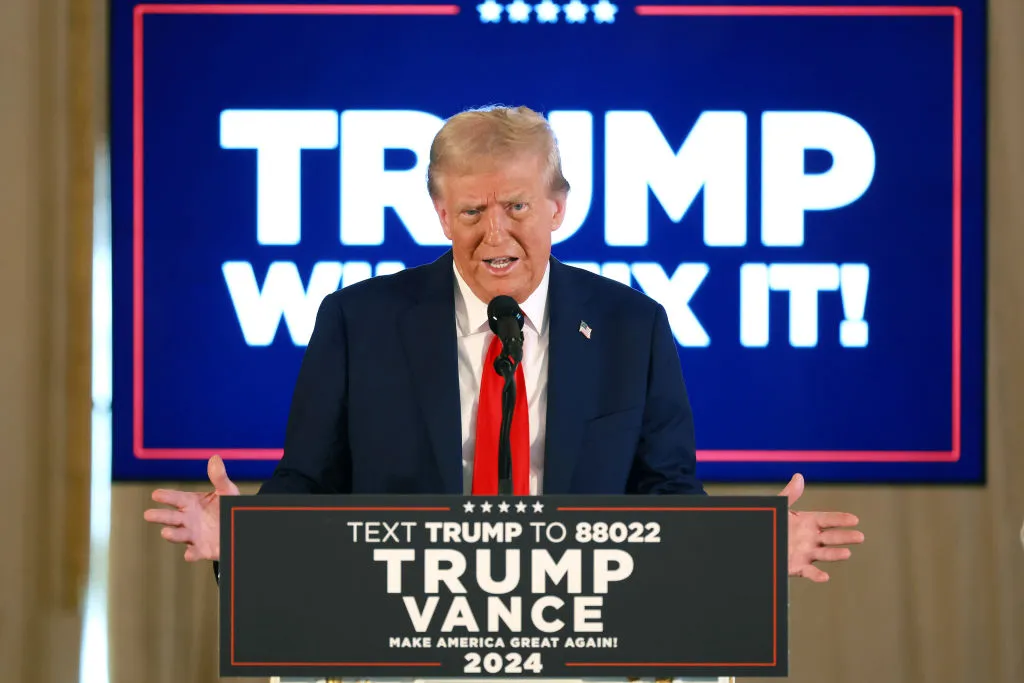

Donald Trump

While a Harris administration would have an opportunity to build on climate progress made under Biden, outlines of how Trump would approach ESG issues, should he win a second term, lie in the actions of both his first administration and the past two years of the Republican-led House of Representatives.

During an August interview with Elon Musk, Trump said climate change or global warming is not “the biggest threat” and claimed it would, in fact, create “more oceanfront property,” adding to concerns climate activists and advocates have about what a second administration under him would look like.

A second Trump tenure would likely abandon defending, stop developing or rescind a variety of ESG-focused rules in the Department of Labor and the SEC, and also look to claw back as much of the clean energy tax credits in the Inflation Reduction Act as possible, per experts.

A Trump presidency would have negative impacts on the clean power, transport and industry markets, as well as sustainable finance. “Very negative” effects can be expected on those sectors’ business prospects should Republicans control both the House and Senate, as well, according to an energy-focused election outlook from BloombergNEF. The oil and gas sector is the only climate-related sector that would receive a boost on its business prospects under Trump, with a “very positive” impact on those prospects under unified Republican control, according to BNEF.

The aftermath of Trump’s anticipated climate-focused pullbacks and policies would ripple through federally-regulated retirement plans, how corporations report material risks and the ecosystem of companies that have sprung to help aid sustainability initiatives.

A change in agency directives

Should Trump return to office, the agencies supporting him would have different objectives and ESG-related measures pending for the Labor Department and SEC could be dead soon after.

Trump’s first stint was “not very favorable to a lot of Department of Labor initiatives,” and ESG was an area that saw the most focus, per Josh Lichtenstein, a Ropes & Gray partner who leads the firm’s Employee Retirement Income Security Act (ERISA) and benefits practice.

The Biden administration’s Labor Department is currently defending a rule that allows pension fund managers to consider ESG factors as a tiebreaker. The rule, which has been in effect since January 2023, was designed to counteract a “chilling effect” from a rule implemented by the Trump-era Labor Department, the agency said when issuing the 2023 rule.

The prior fiduciary rule was written so broadly that private 401k plan fiduciaries — governed by ERISA — were concerned that including even non-sustainability focused index or target funds could result in plan sponsors being accused of allegedly having considered ESG factors as part of the investment decision, Lichtenstein said.

Lichtenstein expects the Trump administration to find a way to go back to the 2020 fiduciary rule that chilled pension plan managers. If a final determination isn’t reached in the legal challenge by the change in administration, a Republican-led government would likely stop defending it in courts, and the department would likely return to its focus on “pecuniary factors,” Lichtenstein said.

“While the rhetoric that you would hear from the Trump administration about that rule would generally be [that] this is just protecting retirees, I think that a lot of plan sponsors and a lot of industry participants, including asset managers, would view a return to that rule as a pretty big problem for actually just the regular operation of retirement plans in America,” he said.

While a reversal of course on DOL’s fiduciary rule is expected to cause upheaval and uncertainty, the same concern is not there for businesses, should a second Trump SEC decide to drop the agency’s climate-risk disclosure rule, which is already facing several legal challenges.

The House of Representatives has railed against the climate-risk disclosure rule promulgated by Chair Gary Gensler’s SEC, and House-passed budget bills include policy riders to strike both the DOL’s fiduciary rule, and the SEC’s climate rule. The lower chamber’s actions over the past two years — which include using ESG and the two agency rules as an occasional boogeyman — could set a template for the next Trump administration’s actions on the topic.

Beyond the SEC’s rule, however, the European Union has its own corporate ESG disclosures that are set to require U.S. based companies to comply beginning in 2026, and California also has a climate risk disclosure rule stateside, with other states considering following suit.

“You're going to have to do this at some level,” Kalyanam said. “Many, many, many large companies are already looking at it. So it may not be the SEC, but it's going to be affecting some market that you're operating in.”

Could Trump claw back IRA credits?

While Trump has made clear he would look to have the U.S. leave the Paris Agreement, again, he has also signaled an intention to claw back as much of the Inflation Reduction Act credits as possible. However, a second Trump administration could find it difficult to undo his predecessor’s cornerstone climate action legislation.

While a change in direction at DOL and SEC would largely be a matter of direction and remit, any Trump repeal of IRA credits would require Congressional approval, which Kalyanam and Derrick Flakoll — a BloombergNEF U.S. Policy analyst — agreed was unlikely, even with a Republican-controlled Congress. Flakoll noted in emailed comments that 18 Congressional Republicans already publicly oppose an IRA repeal.

More likely, a Republican-controlled Congress would look to sunset tax credits for projects that begin construction after 2026. Such a scenario would represent the “toughest plausible scenario” for the renewables market, according to Flakoll. BNEF’s tax credit repeal scenario — modeling the impact of a 2026 sunset date — would lead to a 17% reduction in wind, solar and energy storage buildout.

“Politicians' reluctance to disrupt the business environment makes it more realistic to expect a gradual phase down of the credits over several years and/or a sunset date beginning a few years down the road, but earlier than currently expected,” Flakoll said in emailed comments to ESG Dive.

Flakoll noted that currently, the clean power production and investment tax credits in the IRA aren’t set to phase out until the U.S. power system reduces its emission by 75% from 2022 levels. He said at the earliest, that would peg their uninterrupted phaseout date in the late 2030s.

Kalyanam — who helped craft many of the tax provisions on the Capitol Hill during her role as a longtime aide and served as deputy assistant strategy for tax and budget at the Treasury Department from 2021-22 — said in a split Congress, she doesn’t see Democrats looking to weaken their landmark legislation unless it becomes a revenue need. If necessary, any changes in a split Congress could come from “nipping and tucking” by doing things like reducing the credit percentage or additive credits, she said. Kalyanam can also envision potential scenarios where the credits are set to sunset sooner than expected or onerous restrictions are added.

Any of these scenarios will require businesses to restructure their business plans to ensure their projects will still qualify for the credits in time or at all, she said. The amount of adjustment needed will depend on the level of changes made. However, even if Republicans gain unified government control, Kalyanam said it’s hard for her to imagine them legislating away the credits.

“A lot of this IRA investment has gone into Red states,” Kalyanam said. “Red states represented by Red senators and Red House members. … Even if they didn't give out those tax credits [or] didn't vote for them, it's not easy to take them back. It just isn't, and both sides would agree on that.”