Dive Brief:

- Guess Inc. received a proposal to go private from WHP Global, per a Monday press release.

- The nonbinding proposal, which came through WHP’s affiliate WHP Investments, is an offer to acquire the more than 51 million outstanding shares of Guess for $13 per share in cash, which is above the current share price of $12.62. Guess has a market cap of $649 million.

- WHP’s offer excludes shares held by CEO Carlos Alberini and Guess co-founders Paul Marciano and Maurice Marciano, the three of whom collectively own 50.3% of the company, according to securities filings.

Dive Insight:

The proposed transaction would be financed “through a combination of equity and third-party debt financing” as well as rollover or reinvestment by the Marciano brothers and Albertini, per the release.

The offer additionally assumes that Guess “will operate in the ordinary course of business and that there will be no material change” to its strategic and operational position, according to the announcement.

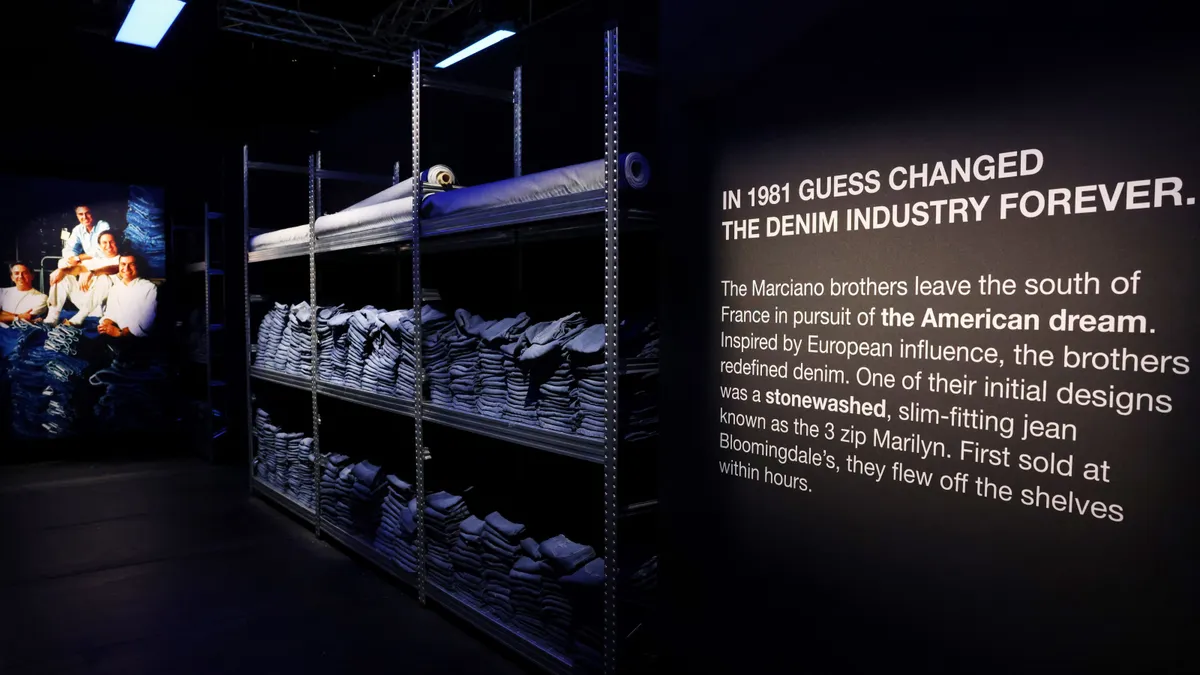

The Marciano brothers co-founded Guess in 1981. Paul Marciano is the company’s current creative director, while Maurice Marciano retired in 2023.

The board at Guess is evaluating the offer with help from outside financial and legal advisors, per the release, which added that there’s no definitive agreement in place at this time, and that Guess “does not intend to comment further on this matter until the Special Committee has completed its evaluation of the proposal or until further disclosure is deemed appropriate.”

Last year, Guess and WHP bought denim brand Rag & Bone. Under the terms of that deal, Guess paid $56.5 million to acquire the brand’s operating assets, and Guess and WHP both became owners of Rag & Bone’s intellectual property through a joint venture.

In fiscal 2024, Guess’s total net revenue increased 3.3% year over year to $2.78 billion.

WHP’s holdings include Joe’s Jeans, G-Star, Express and Bonobos. The company announced last year that it would also acquire the intellectual property of the Vera Wang brand.